Since merchants started using Bitcoin and other cryptos as one of their remittances, they cited a crucial issue that is price instability. For instance, a luxury item distributor, accepting crypto for their products saw the value of their luxury cars rise by almost 33 percent in the trial. The firm called as ‘The White Company’, later decided to join the trend of launching stablecoins, fusion of fiat currency and cryptocurrency. The firm further promised to protect its balance sheets from tenuous influences.

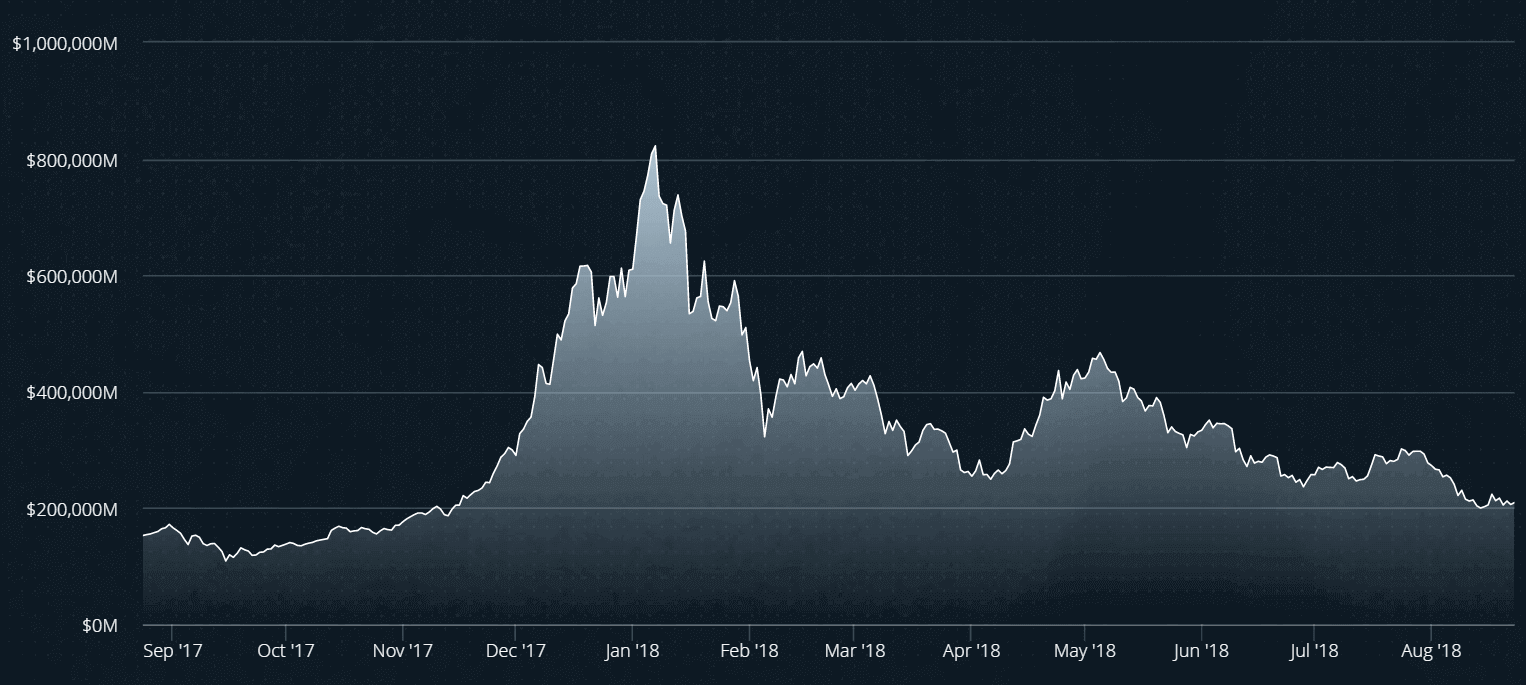

The downfall witnessed some major cryptos lose 80-90 percent of their market cap in a year. Consequently, majority of potential investors decided to exchange them for the stablecoins to avoid risk. And once, the price volatility settled, the traders started retrieving their stablecoins for cryptos and fiat currencies to withdraw the cryptocurrency market on with minimal losses.

Stablecoins and Remittances

According to a study, stablecoins are not as exciting as hypothetical asset. This is due to their supporters supply only the part that they can support counter to a stable real-world asset. Stablecoins are most attractive tools when it comes to maintaining blockchain-powered remittance networks for hedging and payments.

It is now that the established players have started to know the potential of stablecoins. According to a crypto research team report, investments made in the stablecoin industry has reached three billion. As a result, it led to the launch of more than 120 stablecoin projects in 2018.

Almost every player in the stablecoin industry is coming with their audit reports. This confirms that the firm that is planning to introduce its stablecoins has enough assets to support them. And some stablecoin projects have launched features that let them cease or remove coins to handle the illicit acts.

Meanwhile, a major stablecoin Tether is being criticized for declining to get its balance sheets audited by an independent agency.

Some attorneys believe that for the long-term, almost every traditional sector would want to integrate a stablecoin solution. For instance, Social media giant Facebook has recently announced that it will launch a stablecoin to power peer-to-peer remittances on its WhatsApp platform.

.