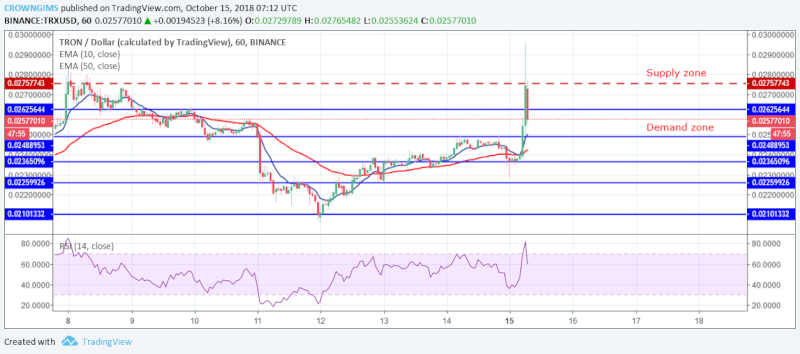

Tron (TRX) supply and demand zones:

Supply zones: $0.027, $0.30, $0.34

Demand zones: $0.024, $0.023, $0.022

Tron (TRX) Medium-term Price Analysis: Bullish

TRX/USD was bullish in its medium-term outlook. On October 11 with the pressure from bears, the coin reached the low demand zone of $0.021. It was rejected by the bulls’ force with the formation of bullish inside bar candle. This was then followed by more bullish candles and the price rallied to the north and broke the former supply zone of $0.023. The bulls were in control of the market yesterday.

TRX/USD was bullish in its medium-term outlook. On October 11 with the pressure from bears, the coin reached the low demand zone of $0.021. It was rejected by the bulls’ force with the formation of bullish inside bar candle. This was then followed by more bullish candles and the price rallied to the north and broke the former supply zone of $0.023. The bulls were in control of the market yesterday.

Currently, bulls increased their momentum and the price rally to the north. It has broken the supply level of $0.027 and has already exposed the supply level of $0.30. The 10-day EMA has crossed the 50-day EMA upward. The price is above the 10-day EMA and 50-day EMA indicating buy signal. The stochastic oscillator 14 is above 60 levels and its signal lines point to the north, thus signaling an uptrend movement.

Tron (TRX) Short-term Price Analysis: Bullish

TRX is bullish in the short-term outlook. The market continues in its bullish trend which started a few days ago. It has moved towards the upper supply zone of 0.027. The coin is above the demand zone of $0.024 with the probability of moving higher as the price is above the10-day EMA and 50-day EMA which connotes buy signal.

In case the bears increase their momentum the coin may be pushed down as a retest to the supply zone of $0.027. The stochastic 14 is below the 80 regions with signal lines pointing toward the south which indicates a sell signal as a pullback.