Crypto derivatives have gained serious traction in the past few years, but for many traders, the biggest challenge isn’t entering the market – it’s figuring out how to structure trades. Spreads, straddles, and hedges often look confusing at first glance, especially if you don’t have the time or confidence to build them from scratch.

Delta Exchange, an Indian crypto exchange, steps in with a practical solution – its strategy builder. These features give you a head start – helping you test, plan, and refine before putting capital at risk.

In this blog, we’ll discuss what these pre-built strategies are, why they matter, and how Delta makes them simple to use.

What Makes Crypto Strategies Useful?

Pre-built strategies are ready-made trade setups that combine multiple positions – like spreads or straddles – into a single basket. Instead of manually adding each leg, you can add basket orders and preview both profit and loss involved.

For new traders, this is a big time-saver. Complex strategies usually demand trial-and-error, and mistakes can cost money. Even experienced traders benefit – you can quickly deploy hedges or volatility plays without rebuilding everything from scratch.

In short, testing pre-built strategies provides clarity, speed, and a smoother entry into the live crypto market.

How Delta Exchange’s Strategy Builder Works

Delta Exchange’s strategy builder is a hub where you can build or test multi-leg crypto strategies with complete visibility. It combines features like:

- Basket orders, where you can place multiple trades in one go.

- Payoff charts, where you can see potential gains and losses visually.

- Greeks, where you can track sensitivity to price, volatility, and time decay.

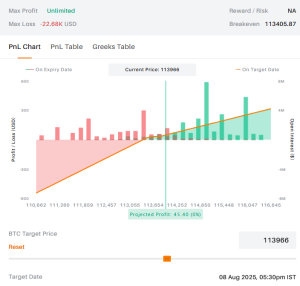

Payoff chart on Delta Exchange’s strategy builder

You can test bull call spreads, bear puts, straddles, or strangles. You can tweak strike prices, adjust quantities, or change expiry dates before hitting execute.

Whether you trade on mobile or desktop, the builder gives you flexibility, making complex crypto derivatives trading much easier to manage.

Testing Before You Trade: Why it Matters

In crypto markets, where volatility is the norm, testing matters just as much as execution. Without simulation, you could rush into a trade that looks good on paper but behaves differently in practice.

On Delta Exchange – with payoff charts and a demo account – you can see outcomes under different market conditions before committing. Let’s say you test a straddle – if volatility rises, you profit. But if the market stays flat, losses add up. By seeing this in advance, you know the risks clearly.

Testing gives you space to slow down, refine decisions, and enter live trades with more confidence.

Step-by-Step: Trying a Strategy Builder on Delta Exchange

If you’ve not yet set up an account on Delta Exchange, sign up now and visit www.delta.exchange for the next steps.

- Log in to your Delta Exchange account.

- Go to the Strategy Builder in the More tab.

- Select the asset (BTC or ETH) and choose expiry.

- Add multiple legs to your strategy.

- Review the payoff chart, profit and loss, and Greeks.

- Adjust quantities or legs if required.

- Check margin requirements before proceeding.

- Execute as a basket order with one click.

Tips to Manage Crypto Derivatives Trades Well

Many traders slip up by chasing market noise or copying social media tips without checking risk metrics.

- Skipping stop-losses or exit plans often leaves your positions unprotected.

- Another common error is overlooking margin needs – running out of funds mid-trade can cut strategies short.

- Some even miss chances by holding too long instead of booking profits on time.

- Staying disciplined with planning, margin checks, and timely exits keeps you safer in crypto derivatives trading.

Balancing Automation With Control

Another advantage of Delta Exchange is that, via Tradetron integration, you can automate strategies and let systems handle execution. This is especially handy for advanced traders who run multiple setups or are interested in algo trading.

Automating crypto derivatives trades with Delta’s algo trading bot

But automation doesn’t mean hands-off trading. You still need to review payoff charts, understand risk exposure, and align strategies with your view of the market. Automation helps with speed and consistency, but the final responsibility always rests with you. Think of it as a way to execute more efficiently while keeping control over the bigger picture.

Final Thoughts

Delta Exchange makes it easier for you to approach structured trades without second-guessing every step.

The strategy builder gives you the best of both worlds – simplicity through ready-made frameworks and depth through Greeks, payoff charts, and automation support. Whether you’re new or experienced, using these tools helps you manage risks instead of being caught off guard.

If you want safer, smarter ways to approach crypto derivatives trading, Delta Exchange provides a practical place to start.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. Please conduct your own research and consult experts before making any investment decisions.

![]()