XYZ is heading to public markets after MEXC confirmed a January 29 listing, with trading set to begin today at 1 PM UTC via the XYZ/USDT pair. The exchange is also running a launch campaign with a 50,000 USDT reward pool plus APR booster incentives for users who take part.

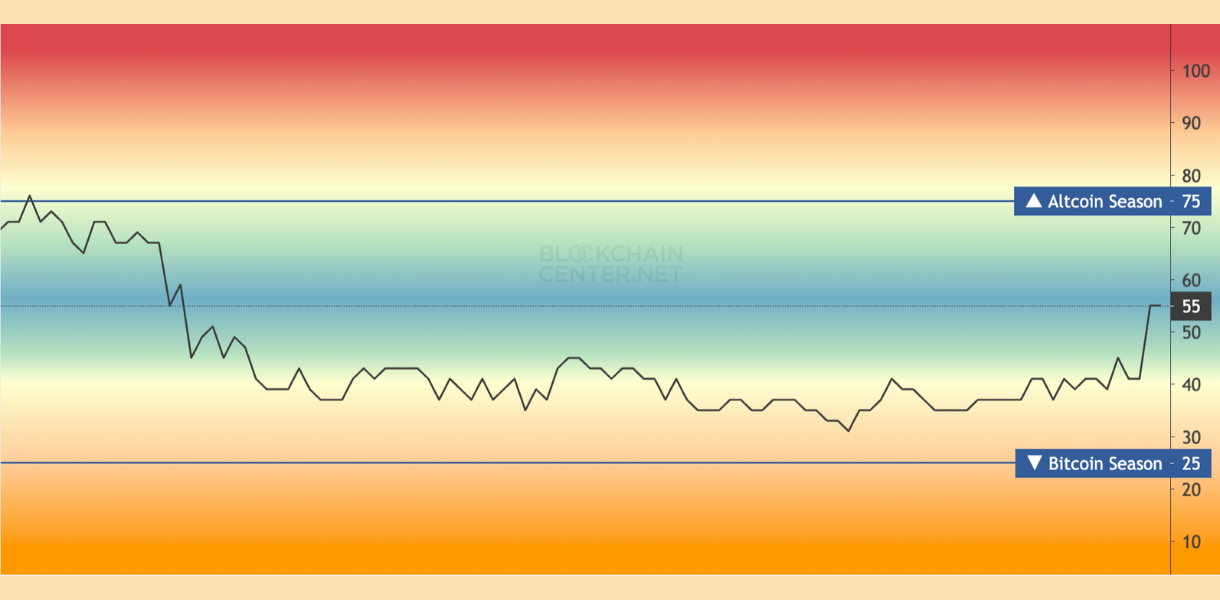

The announcement comes at a moment when the crypto market is showing renewed energy as 2026 gets underway. That shift is reflected in the Altcoin Season Index, which recently climbed to 55 – its highest level in three months. A reading of 75 is generally seen as a full altcoin season, when alternative assets clearly outperform Bitcoin. At 55, the index suggests that altcoins are starting to gain traction, though the market hasn’t fully shifted yet.

In that kind of environment, attention often begins to spread beyond Bitcoin toward newer and smaller-cap tokens. Listings (including ones like XYZ) that arrive during this phase tend to draw closer scrutiny, as traders and investors look for signs of where momentum may be forming next.

XYZ is the native token of XYZVerse, a project focused on blending blockchain with esports and sports culture. The team raised close to $16 million during its presale. Pricing increased gradually throughout the presale, suggesting demand developed over time rather than appearing all at once.

At the upcoming token generation event, XYZ is expected to enter the market at a price of $0.10. Once trading begins, however, price discovery will be determined by open-market activity.

On the product side, XYZVerse uses the token to power fan participation around esports events. That includes voting on maps, making predictions, and interacting with digital items tied to match outcomes, giving the token a role in how users engage with competitions rather than leaving it purely as a trading asset.

The total supply of XYZ is fixed at 100 billion tokens. Just under 18% was sold during the presale, while more than 17% has been set aside for long-term token burns. Platform revenue flows through XYZVerse’s on-chain router, where a portion is used for buybacks and burns, gradually reducing the circulating supply as usage grows rather than relying on speculative demand alone.

Only about 0.5% of the sale supply will be circulating at launch, with the remaining tokens rolled out gradually as part of a vesting structure designed to support more balanced market conditions.

Recently, XYZVerse migrated XYZ to the BNB Smart Chain (BSC). This could lead to increased exposure for XYZ as it becomes integrated into a larger and more active blockchain network. The migration could also help XYZ increase its liquidity, making it easier for users to buy, sell, and trade the token on different platforms.

![]()